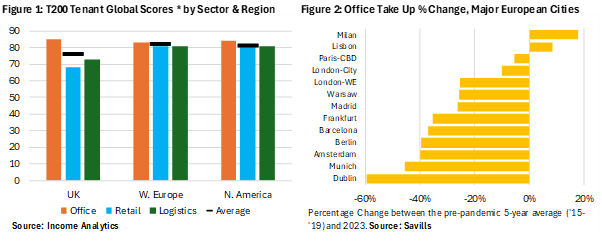

Income Analytics Commercial Property Webinar: The Outlook for the Listed Property Sector

Income Analytics closed its 2025 webinar series with a deep dive into one of the most pressing issues in UK real…

Read more...

19.11.25