Income Analytics releases industry market averages to the platform

14.03.22

We are pleased to announce the product release of our Top 200 Industry and Property Sector Averages. This is the result of months of analysis by our research team, bringing this data to life for the first time.

The INCANS® Top 200 Averages have been developed by Income Analytics using company level data provided by Dun & Bradstreet. They calculate the % probability of tenant default for the top 200 companies in each of the 83 x SIC 2 industry code types across a particular country or geographic region. By grouping companies together by their business activity, we have been able to construct industry and sector average risk scores that clients can use to measure their tenant, asset or portfolio against the wider market.

This went live across the platform on 7th March 2022. From here you can begin to drill down into specific sectors and industry groups.

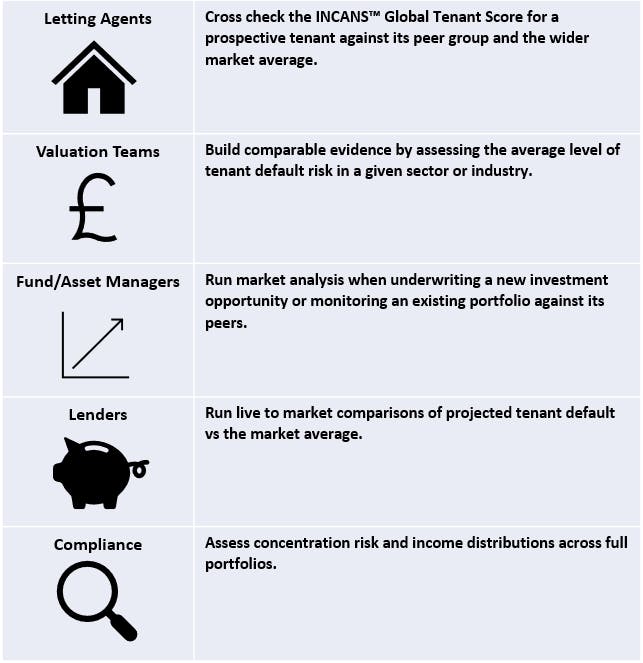

How are different investors using Market Averages?

If you would like further information or to run through with a member of our team, please get in touch with us at info@incans.com

Related Stories

Income Analytics Webinar - Revisiting Retail

Join Income Analytics CEO Matt Richardson on 12th May for an in depth discussion on why Retail Real Estate is back on the menu with some investors and the key trends driving the sector across UK and continental European Markets.

Q4 2024 Income Analytics T200 Reports

March, 12th 2025, London. Income Analytics' releases its latest T200 reports.

Review - Why Logistics Real Estate Leads the Way

The Income Analytics webinar, "Why Logistics Real Estate Leads the Way: Stability, Demand, and Resilience," explored key trends and investment strategies in the European logistics real estate market.

Q3 2024 Income Analytics T200 Reports

January 14th, 2025, London. Income Analytics' releases the latest T200 reports showing commercial real estate continues to deliver a durable income stream across multiple sectors.

The Problem with UK REITS

January 13th, 2025, London. Our CEO, Matt Richardson, has been published discussing UK REITS in The Property Chronicle.

Q2 2024 Income Analytics T200 Reports

September 23rd 2024, London. Income Analytics' releases the latest T200 reports showing a lead for Healthcare while Hotels lag.

Divergence within UK Retail Parks

July 29th 2024, London. UK Retail Parks have some strong occupiers, but there are weaker credit risks landlords should look out for.

Office Inflection

July 19th 2024, London. Investors to make sense of the strong credit ratings of many of their typical office tenants, with slowing take-up and falling values across the sector.

Anne Conlan Joins Income Analytics

July 9th 2024, London. Anne Conlan has joined Income Analytics as Account Director to support existing clients.

Income to Drive Total Returns

July 4th 2024, London. Real estate association INREV released a survey showing 79% of respondents believe income will drive return. How are investors ensuring they have strong, stable cashflows?

Q1 2024 Income Analytics T200 Reports

May 22nd 2024, London. Office occupier scores are stable across all regions, while some UK sectors are being hit by the cost of living crisis.

Q4 2023 Income Analytics T200 Reports

March 6th 2024, London. UK retailer scores struggle to improve while European logistics operators trend higher. Healthcare continues to be strong globally.

Income Risk is Specific. Avoid Averages.

Focusing on averages can hid tenant specific risks.

Q3 2023 Income Analytics T200 reports

November 28th 2023, London. A common theme across all our regional T200 reports is a recovery of the leisure sector tenants post-pandemic. They have bounced back from a low base, and typically record INCANS® Tenant Global Scores below their regional averages, but they are the fastest improvers.

Matthew Richardson Interview: Further Corrections and Opportunities to Emerge

The main trends impacting the sector are non-property, external factors, our co-founder & CEO Matt Richardson pointed out when speaking with Real Asset Media at EXPO Real 2023. These are, notably, interest rates, central bank policy and political policy.

Q2 2023 Income Analytics T200 reports

August 22nd 2023, London. The latest T200 reports from Income Analytics (INCANS) shows a mixed picture for retail sector tenants across the UK, Western Europe and North America. In Europe, retailers score below their regional averages, while in North America they trend above the average. The leisure sector has improved but remains below average in Western Europe, while has rebounded after the pandemic to score above average in the UK and North America.

Q1 2023 Income Analytics T200 reports

June 20th 2023, London. The latest T200 reports from Income Analytics (INCANS) shows the UK hospitality tenants continuing to be the best improvers, albeit from a low base after the pandemic. However, their European counterparts have not shown as much improvement. European pubs & restaurant scores have remained static over the last 12-months. In the US however the same tenants are seeing falling scores. Perhaps discretionary spend has been hit harder in the United States. Motor dealerships, a representation of larger discretionary spending, has seen tenant scores (and therefore the likelihood of default) fall across all three regions.