"Why The UK's Supply Chain Crisis Could Be A Mega-Headache For Landlords"

21.09.21

From McFlurries to carbon dioxide gas, via ordinary household groceries and Haribo sweets, the UK is in the grip of a supply chain crisis.

Exclusive data provided to Bisnow shows it likely means more bad news for landlords, some of whose tenants may now fail to make it through the vital pre-Christmas trading period.

Every day something new falls into the vortex of the UK’s supply chain crisis.

An ever-growing list of life’s essentials (and some of its luxuries) are either suddenly unavailable, or scarce enough to force eye-watering price rises.

Sometimes it’s just inconvenient, like the snap shortage of chicken pies or Ikea furniture, and sometimes it really matters. For instance, the UK ran out of the glass vials needed for blood tests, and currently has no supply of CO2 gas.

To be fair, some of this is a symptom of a wider global problem. The blood test vials became unavailable because a U.S.-based supplier let down the NHS. The CO2 problem — which poses all kinds of knock-on threats to food packaging and supply — was a consequence of a worldwide rise in energy prices.

But behind the see-sawing struggle of the global economy to recover from pandemic, there sits a uniquely British problem. The pandemic coincided with the Brexit-related exodus of European workers, creating a massive labour market shock. The number of vacancies throughout the economy is at a record high, and it is particularly acute among the drivers of heavy goods vehicles. There are thought to be 100,000 HGV driver vacancies, meaning 1 in 6 driver jobs are unfilled.

Add the additional friction created by new border paperwork, and the Brexit-related disruption of four decades of trading arrangements, and you have a perfect storm.

At the macro level there are suggestions that a period of stagflation could be on the way.

Down at the micro level, the big danger is that supply chain glitches are the final straw for many retail and leisure operators as they fail to hit their Christmas trading targets. The result would mean more tenant defaults, more impaired rental income and, inevitably, more pressure on capital values. It could even tip some landlords over the edge.

These are gloomy possibilities. So how likely are they to come to pass?

Data shows UK retailer stock levels are at historically low levels — the lowest since 1983, according to one estimate.

This suggests that further supply chain disruption could quickly leave shelves empty, with rapid consequences for takings, turnover and profit.

It has also become clear that the run-up to Christmas, always the key trading period, is more important than ever this year, as retailers and leisure operators attempt a recovery from lockdown and 18 months of suppressed in-person trading. In particular, they need to generate cash ahead of the March 2022 end of the moratorium on landlord action to recover commercial rent.

“A strong Q4 2021 is crucial to ensure retail businesses are able to absorb returning to full operational cost outlay despite trade and footfall in city centres improving but still not returning to pre-pandemic levels,” CBRE Head of Retail Occupier Services Graham Barr told Bisnow. “Strong trading in the run-up to (and over) the Christmas period will be key to prevent a repeat of the business failures seen in 2020. However, this still may not be enough, so there may be requests for additional assistance measures in some instances.”

On top of this, retail and leisure operators have been getting progressively worse at paying their rent as the economy opened up — more or less exactly the opposite of what might have been expected. This is a big, red flashing warning light as the September 2021 quarter day approaches next week.

“You would have thought the summer’s economic reopening would have shown the economy reviving, and yet the rental collection data doesn’t paint a fantastic picture," said Re-Leased researcher Caleb Dunn, analysing 30,000 leases. "Rental collection in retail is still 10-15% behind that in other property sectors.”

“The issue for the landlords is that each quarter day compounds the effects. The amount of rental delinquency is building up. Look, for instance, at how much rent is paid on the quarter day itself and that figure is sliding backwards. It was just 8% in June, down from 17% in December 2020, and far down on December 2019. Compare that 8% with the equivalent 33% in the office sector, and it's clear the retail sector’s delinquency is getting progressively worse.”

The MSCI UK Quarterly Property Index, drawing on studies from Income Analytics, suggested that the risk of default in leisure operators doubled between December 2019 and June 2021.

These are all straws in the wind, but they are not encouraging.

Fortunately, we can do better than anecdote. Unique research prepared for Bisnow by specialist data firm Income Analytics can help clarify the risks run by landlords. Using sophisticated algorithms and a mass of unfiltered data, its 'quant' approach offers a degree of clarity.

Bisnow asked Income Analytics to look at a group of 30 retailers who had already faced trading difficulties, or where expectations were impaired, to assess the problems they might face as a result of the current issues in retail and leisure supply chains.

The answer came back that default risks, thanks to the supply chain crisis, are real and serious for some landlords who rely on at-risk tenants. However, they are not yet a very widespread danger.

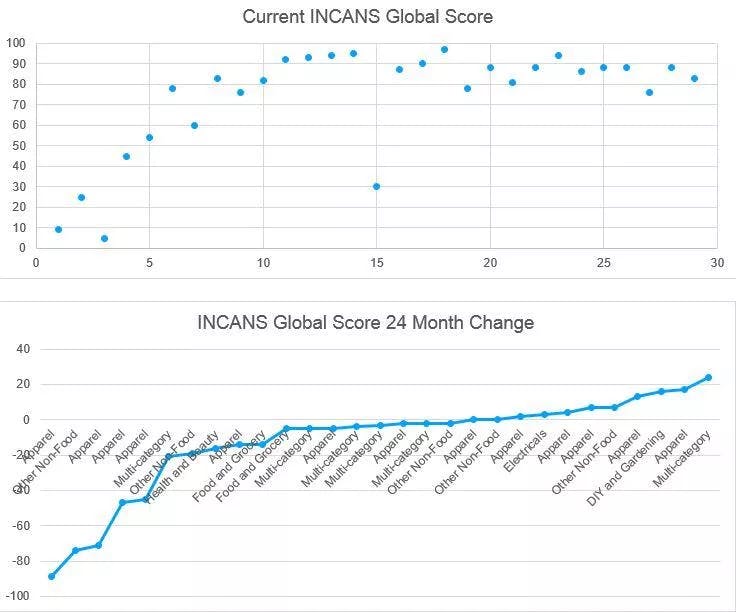

The graphs above show the relative risk of rental default for each retailer based on a high-level analysis of their performance. Data has been anonymised but an indication of their retail sub-sector (apparel, grocery) remains. In the first chart, the higher the score the less likely they are to default: 100 is near certainty they are safe, and anything below 45 indicates a balanced risk they might default.

The second chart measures change over 24 months so that the lower the scores mean a more radical change in the wrong direction. As a glance shows, some retailers are on a sharp downward path and are almost certain to default, with or without additional supply chain disruption.

“With the exception of a few outliers, most retailers are in quite a strong position to withstand shocks to their supply chain,” Income Analytics founder Matthew Hopkinson told Bisnow. “But you can see a distinct decline in the fortunes of some apparel retailers, these are the most challenged, and the most dependent on bricks-and-mortar retail rather than online.

“The second chart shows that the perception that retail is doom and gloom for everything is not right. Yes, there are a few bad eggs and a few outliers driving the perception.”

Hopkinson’s conclusion is that, of the firms analysed for Bisnow, the apparel sector remains at the greatest risk if supply chains remain fragile.

“It depends how long their supply chains are. In apparel it could be China, or it could be Turkey or Spain — and the longer it is, the more issues it raises. There’s also potential for trouble in the relationships with manufacturers, some of whom will themselves have viability problems,” he said.

Does the Income Analytics data suggest that the supply chain crisis could be the straw that breaks many retailers’ backs? For those already weakened, yes, Hopkinson said.

“Increased costs, reduced sales — it is easy to see some businesses will not perform as well. We’ve seen so often how retailers bounce in and out of CVAs (protective administration), then they bleed and bump along until eventually that’s it. Look at our scoring, there are a couple there scoring below 10, that’s pretty low, they clearly have major issues and the supply chain crisis could be the infection that finally kills off a weakened business.

“But if they go, the collapse will have been a long time in the making. The supply chain crisis was just the coup de grace. Some businesses went into this sick, and you can’t run a marathon with flu,” Hopkinson said.

In this sample there were four out of 30 businesses that fell into this category. The data has been anonymised, but it is fair to say that these are not inconsequential retailers. Landlords will notice if they fail this winter. The supply chain crisis will claim victims and by January — the traditional season for retail crisis — we will know who they are.

Read the full article HERE.

Contact David Thame at david.thame@bisnow.com

Related Stories

Q1 2025 Income Analytics T200 Reports

June, 10th 2025, London. Income Analytics' releases its latest T200 reports.

From Global Expansion to Distress: The Story of Groupe Casino

Groupe Casino, the French supermarket giant, has seen both highs and lows in its tenant global scores — and our CEO and Co-Founder, Matt Richardson, has some compelling thoughts on the subject.

Revisiting Retail - Webinar Summary

May, 12th 2025, London. Income Analytics' hosts a webinar focused on the retail sector.

Q4 2024 Income Analytics T200 Reports

March, 12th 2025, London. Income Analytics' releases its latest T200 reports.

Review - Why Logistics Real Estate Leads the Way

The Income Analytics webinar, "Why Logistics Real Estate Leads the Way: Stability, Demand, and Resilience," explored key trends and investment strategies in the European logistics real estate market.

Q3 2024 Income Analytics T200 Reports

January 14th, 2025, London. Income Analytics' releases the latest T200 reports showing commercial real estate continues to deliver a durable income stream across multiple sectors.

The Problem with UK REITS

January 13th, 2025, London. Our CEO, Matt Richardson, has been published discussing UK REITS in The Property Chronicle.

Q2 2024 Income Analytics T200 Reports

September 23rd 2024, London. Income Analytics' releases the latest T200 reports showing a lead for Healthcare while Hotels lag.

Divergence within UK Retail Parks

July 29th 2024, London. UK Retail Parks have some strong occupiers, but there are weaker credit risks landlords should look out for.

Office Inflection

July 19th 2024, London. Investors to make sense of the strong credit ratings of many of their typical office tenants, with slowing take-up and falling values across the sector.

Anne Conlan Joins Income Analytics

July 9th 2024, London. Anne Conlan has joined Income Analytics as Account Director to support existing clients.

Income to Drive Total Returns

July 4th 2024, London. Real estate association INREV released a survey showing 79% of respondents believe income will drive return. How are investors ensuring they have strong, stable cashflows?

Q1 2024 Income Analytics T200 Reports

May 22nd 2024, London. Office occupier scores are stable across all regions, while some UK sectors are being hit by the cost of living crisis.

Q4 2023 Income Analytics T200 Reports

March 6th 2024, London. UK retailer scores struggle to improve while European logistics operators trend higher. Healthcare continues to be strong globally.

Income Risk is Specific. Avoid Averages.

Focusing on averages can hid tenant specific risks.

Q3 2023 Income Analytics T200 reports

November 28th 2023, London. A common theme across all our regional T200 reports is a recovery of the leisure sector tenants post-pandemic. They have bounced back from a low base, and typically record INCANS® Tenant Global Scores below their regional averages, but they are the fastest improvers.

Matthew Richardson Interview: Further Corrections and Opportunities to Emerge

The main trends impacting the sector are non-property, external factors, our co-founder & CEO Matt Richardson pointed out when speaking with Real Asset Media at EXPO Real 2023. These are, notably, interest rates, central bank policy and political policy.

Q2 2023 Income Analytics T200 reports

August 22nd 2023, London. The latest T200 reports from Income Analytics (INCANS) shows a mixed picture for retail sector tenants across the UK, Western Europe and North America. In Europe, retailers score below their regional averages, while in North America they trend above the average. The leisure sector has improved but remains below average in Western Europe, while has rebounded after the pandemic to score above average in the UK and North America.