It has been interesting to follow the fortunes of French supermarket giant Groupe Casino in recent years. We have written numerous research notes for clients who have lease exposure to the business and we weren't too surprised to see that Casino's debt has slumped to distressed levels as fears grow that continued weak earnings could trigger a breach of its loan covenants next year (FT 20/05/2025).

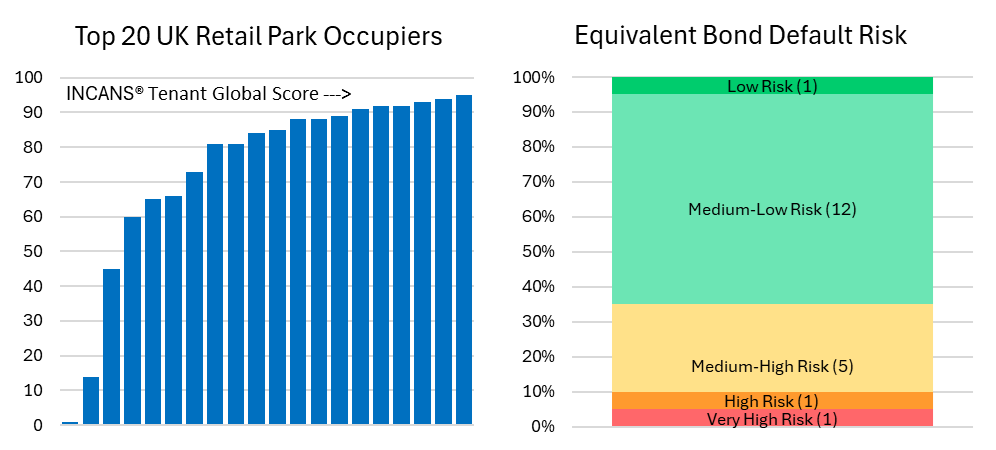

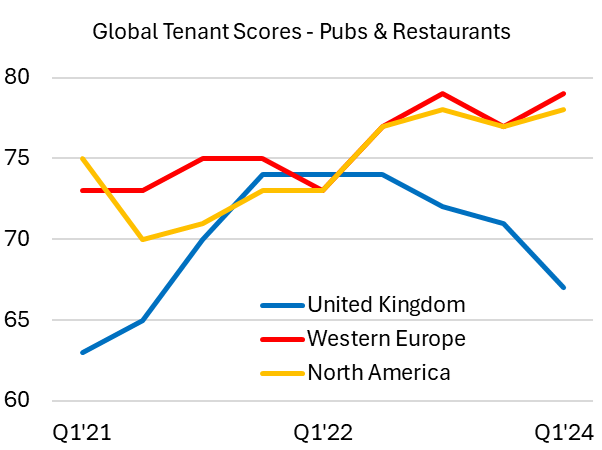

The INCANS Tenant Global Score currently sits at 8/100 meaning the tenant is deemed at High Risk of failure and therefore may not be able to fulfil its rental obligations. The score is linked to a probability of default ("PD rate") and the chart below shows the score over recent years.

The previous owner Jean-Charles Naouri had built the business into a global brand via a series of highly leveraged takeovers which had given it a global reach with outlets in Europe, Asia and South America but the heavy debt pile starved the core retail business of investment.

In 2023 INCANS Tenant Global Score dropped to 1/100 but the business agreed to a comprehensive debt restructuring that saw Czech billionaire Daniel Kretinsky take control.

For a while things stabilised and its score recovered but Casino has continued to lose market share to competitors and in recent months it has come under renewed pressure from debt markets.

Sales last year were reported to be €9bn but the business now has a market value of less than €250m while gross debt is believed to be c€2bn.

This may be a grim read for landlords with exposure to the business but the world of commercial real estate differs from the bond market in several key regards. Most notably in the treatment of debt vs leases.

While there is an increased possibility that Casino may default on its bonds it doesn't necessarily follow that landlords will also be forced to shoulder a loss. In our experience of monitoring indebted retailers we tend to see asset sales or takeovers as the primary exit route. Under both scenarios the assets/business is usually sold to a competitor or new market entrant (often PE) and the landlord simply gets a "new" tenant in the form of the buyer/ultimate parent. Rental income streams generally remain untouched as they form the basis of the value proposition for the incoming investor - especially if they are private equity.

Given the scale and market footprint of Casino this would seem a more plausible outcome in the event of lenders calling time on their debt. Obviously there is still a possibility that Mr Kretinsky might put his hand in his pocket and inject more equity into the business but some form of restructure and/or sale is now a very real possibility.

Here at Income Analytics we will continue to watch, monitor and wait.