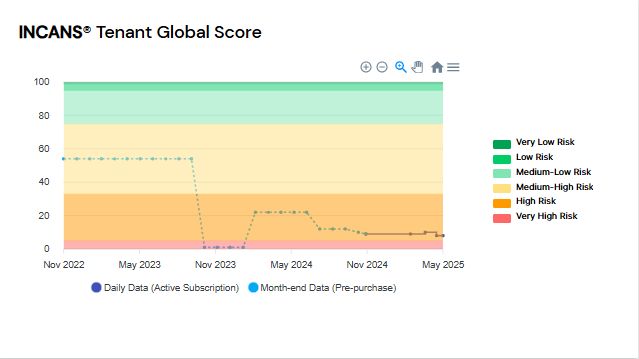

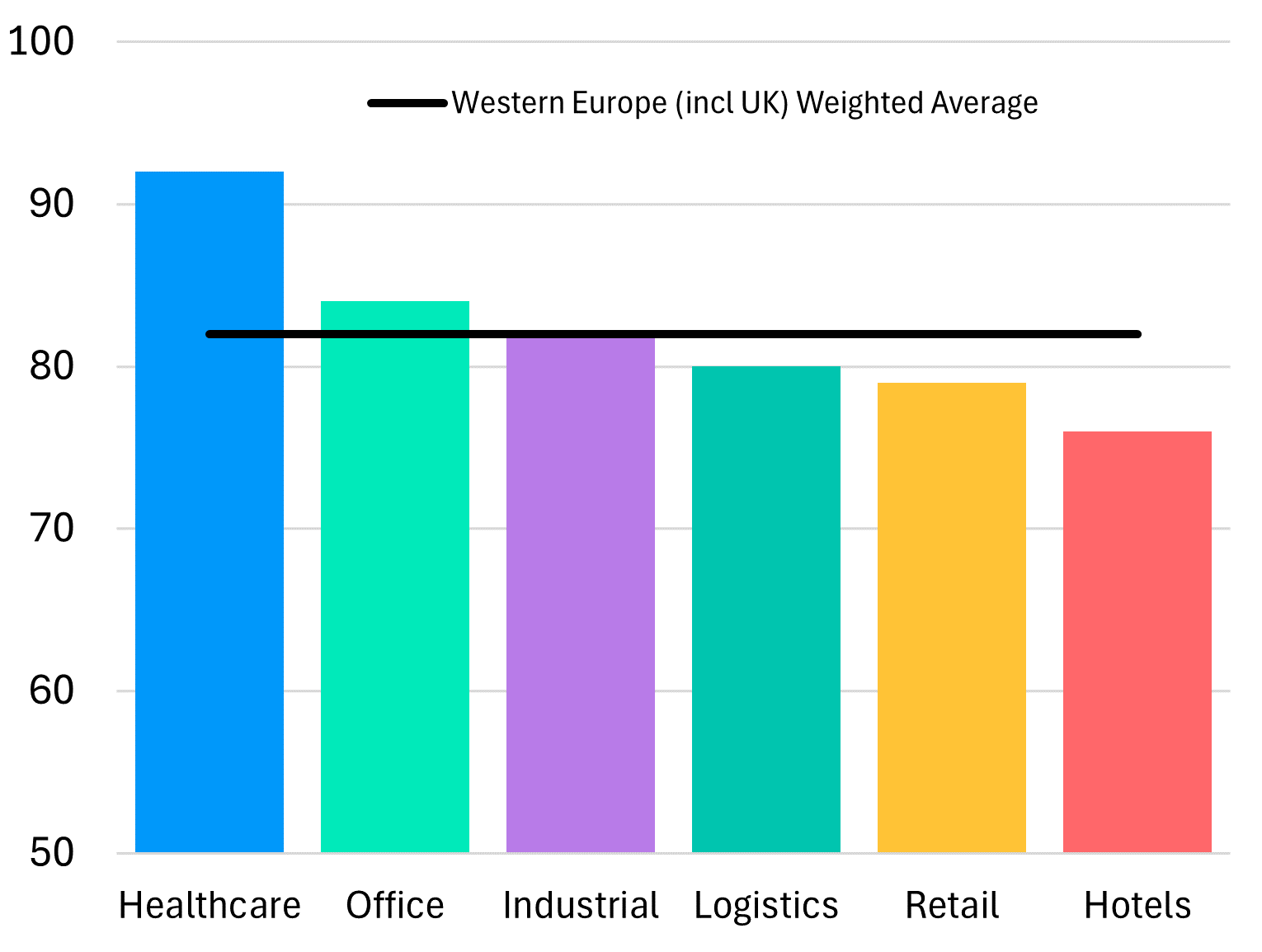

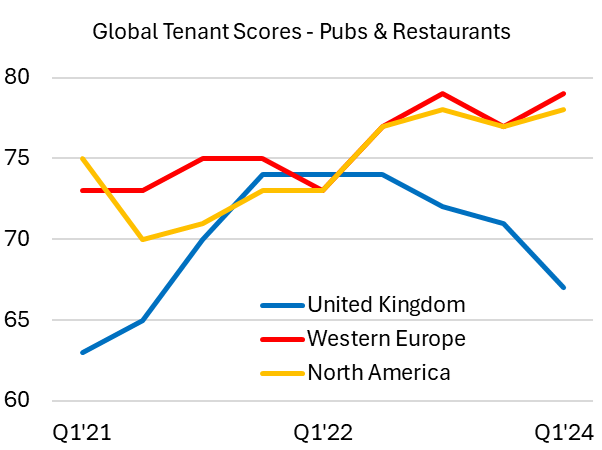

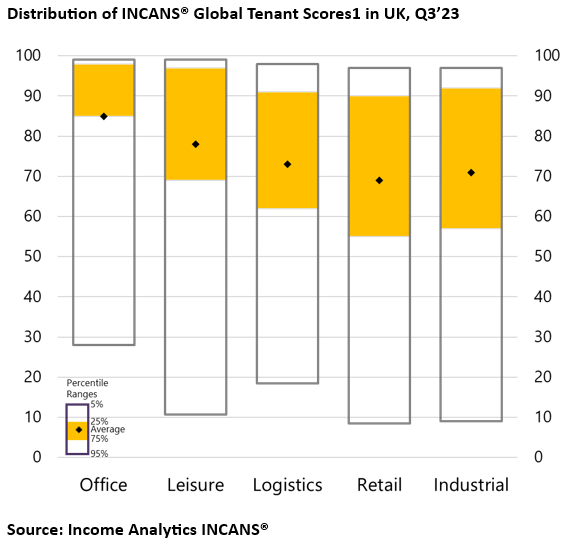

Office landlords and investors find themselves at a tricky inflection point. Income Analytics’ T200 time-series show that the typical institutional office occupier’s credit rating has, on average, remained relatively stable and the average is usually one of the highest recorded for the traditional investment sectors (Figure 1). Many of the occupiers of the largest HQ buildings, such as banks, are also recording record profits. On paper, office investments should deliver the stable income returns investors are seeking.

Yet, as data from Savills shows (Figure 2) take-up of office space across major European cities is significantly trailing historical averages. Landlords are having to adjust to the new norm in many locations – their traditional occupiers are struggling to get employees to return full-time to the office, and therefore have less need for office space. Occupiers are rationalising their footprints to focus on areas that can attract employees back to the office – for instance, areas that are well connected to the transport networks.

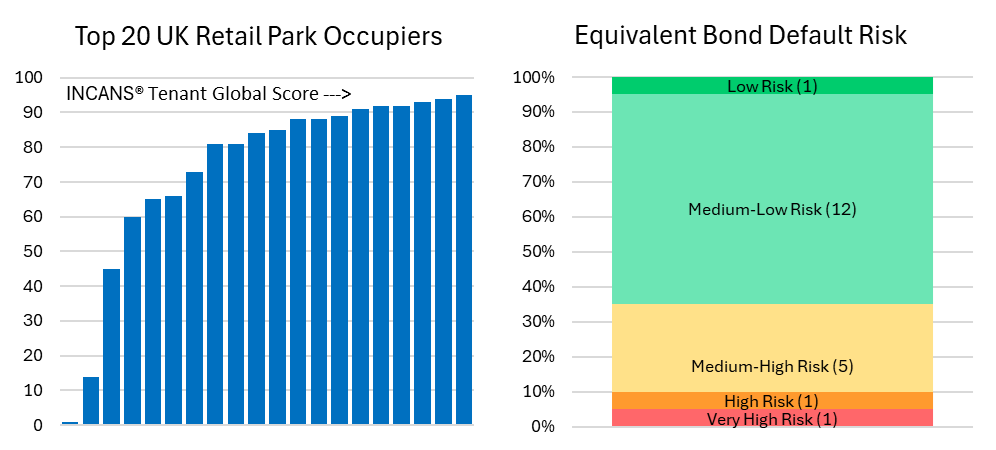

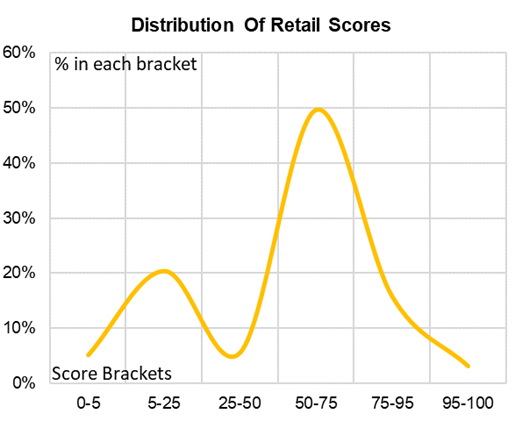

The result is office values are falling and transaction activity is depressed in the first half of 2024. With fewer new tenants hunting for space, and incentives offered by landlords higher, it becomes more important to ensure that the tenant secured for buildings are strong, stable businesses – a landlord does not want to find they secure a tenant, provide build out incentives; only to find the tenant is out of business within a few years. Income Analytics’ INCANS® helps our clients with the due diligence on the prospective tenant as well as allow a view across the corporate tree to find the right place for a rental guarantee should one be needed.

There remains a place for office in an investor’s portfolio, with the adage that it needs to be well-located, good quality with a strong, stable low-risk tenant base generating income.

* The INCANS® Tenant Global Scores predict the likelihood that a company will seek credit relief or fail, 1 being the worst. The T200 series quantifies the default risk across the top 200 standard industry classifications (SICs) for the UK, Western Europe and North America.