Income Analytics closed its 2025 webinar series with a deep dive into one of the most pressing issues in UK real estate: the growing disconnect between the listed market and the private sector.

The session featured insights from three industry leaders:

- Mike Prew, Managing Director at Jefferies LLC

- Andrew Smith, Strategy Director at LondonMetric PLC

- Tom Olsen, CFO at Indurent

The State of the Listed Market

Mike Prew opened with a candid assessment of the UK REIT sector:

“It’s been a very disappointing year. We started with deep discounts to net asset value and high hopes for 2025, but we’re finishing the year where we started.”

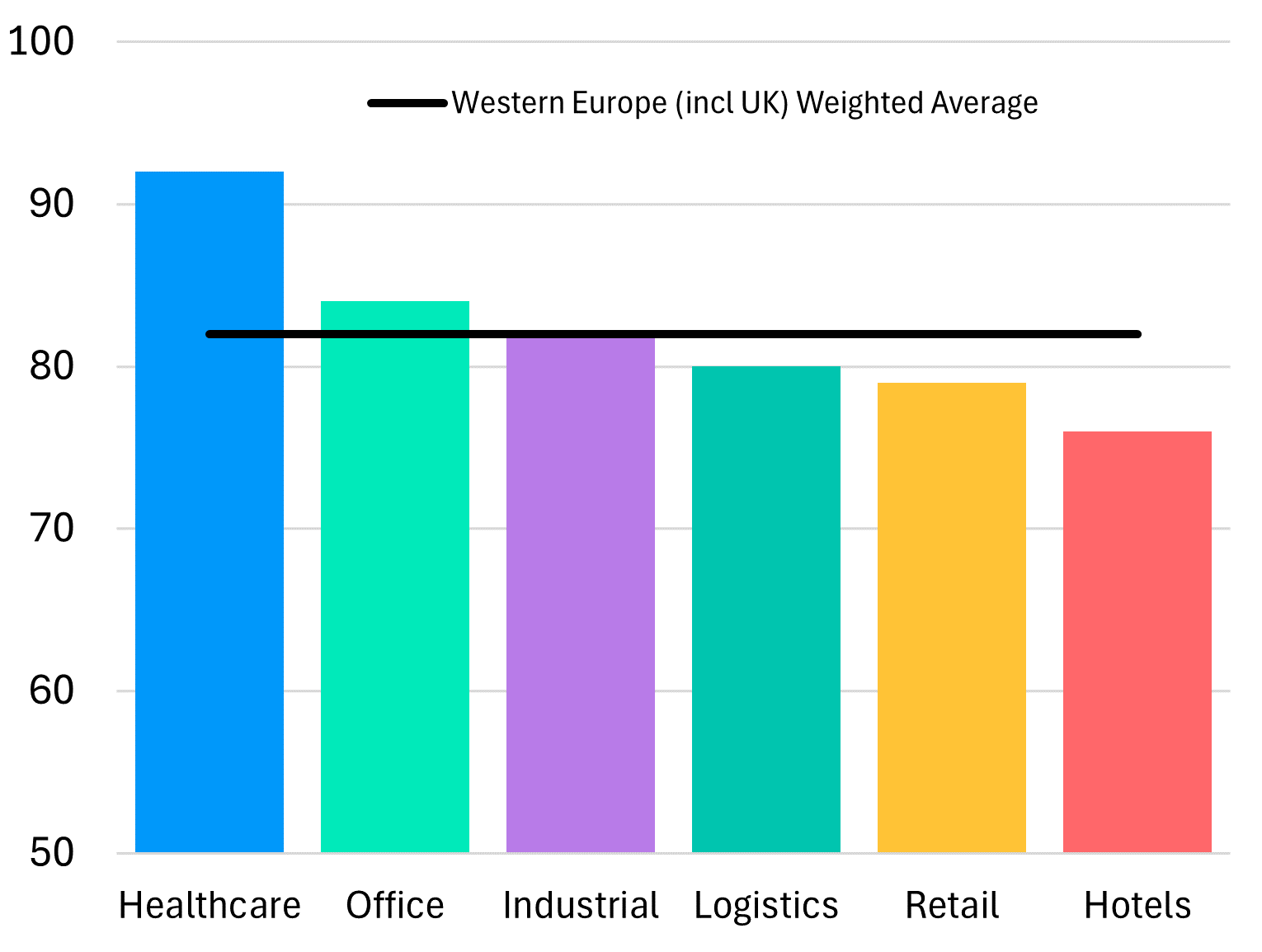

He highlighted that UK REITs are trading at 25–40% discounts to NAV, reflecting structural challenges and macroeconomic headwinds. Prew warned that real estate is increasingly behaving like a bond proxy, with limited equity upside:

“If you don’t get the macro right, you might as well not be in the business. We are a slave to the 10-year gilt.”

Consolidation remains a dominant theme, with M&A activity reshaping the sector. Prew noted:

“The golden decade of commercial real estate was 2010–2020. Higher interest rates have broken that model, and spotting M&A candidates has been more profitable than backing fundamentals.”

LondonMetric’s Income-First Strategy

Andrew Smith offered a contrasting perspective from the listed side:

“We aim to become the UK’s leading triple-net income REIT. Our model is simple: no development – just a laser focus on income and income growth.”

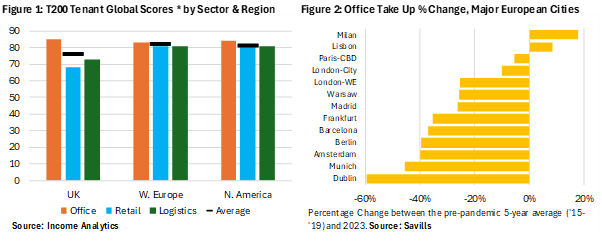

LondonMetric’s £7.5 billion portfolio is concentrated in logistics and convenience-led retail, sectors Smith described as “structurally supported.” He stressed that scale matters:

“Scale drives efficiency and optionality. It gives us access to bigger opportunities and international capital. But getting bigger for bigger’s sake is not a strategy.”

Smith also addressed why investors have shied away from listed property:

“A listed stock is in the shop window every day. There needs to be a compelling reason to own it – and that reason is income. Jam tomorrow doesn’t work anymore.”

Private Equity’s Long-Term Play

Tom Olsen explained why private capital has dominated recent years:

“It’s not just about temporary discounts to NAV. Private vehicles offer more flexibility and control over capital structure, longer-term horizons, and an appetite to act where we have high conviction, which listed companies can sometimes struggle with.”

Indurent, backed by Blackstone, has a portfolio of over 32 million sq ft and is investing heavily in technology:

“We’ve invested over £10 million on technology since our launch. That gives us a modern, data-first platform and the ability to integrate AI rapidly. It’s a huge differentiator.”

Olsen sees logistics as a structural winner:

“You can’t manufacture or store goods at home. Vacancy rates remain low, rents are still growing, and logistics accounts for nearly 40% of UK commercial real estate investment.”

On the prospect of relisting private platforms:

“Listing is definitely an option to access liquidity and there are also other ways of doing this. However, these options and their timings need to be considered alongside the market and sector’s conditions, which need to be right.”

Key Takeaways

- UK REITs remain under pressure, trading at deep discounts to NAV, with consolidation driving sector change.

- Real estate is behaving more like a bond proxy, making macro factors such as gilt yields critical.

- Income is king: Listed players like LondonMetric are prioritising cash flow over speculative development.

- Private equity thrives on flexibility, long-term horizons, and operational upside – especially in logistics.

- Technology and data are emerging as key differentiators for private platforms.

- Relisting may return, but only if equity valuations recover and investor appetite shifts back to property.

To hear the full webinar https://incans.com/-listed-webinar