With UK Retail Park mainstay Carpetright falling into administration, we thought it worthwhile to examine the credit risk across the top 20 UK retail park occupiers. UK Retail Parks attract a wide range of retail types and the top 20 include DIY specialists such as B&Q, discounters like B&M and Home Bargains, and grocers like J Sainsbury and Tesco.

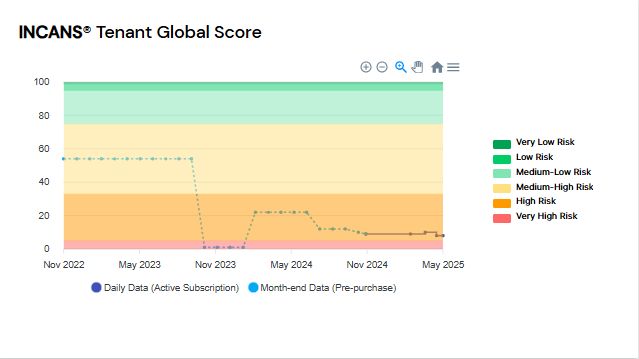

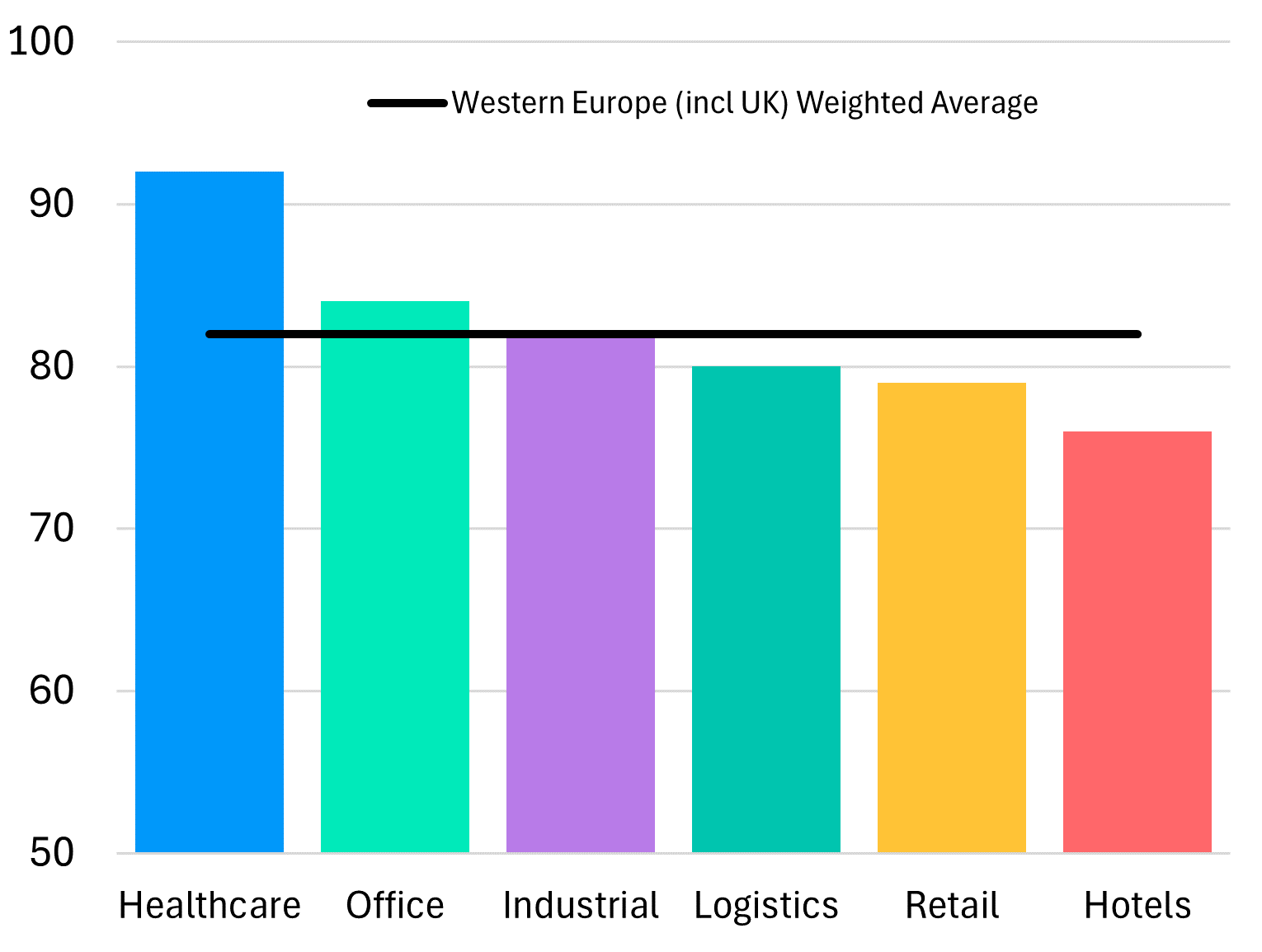

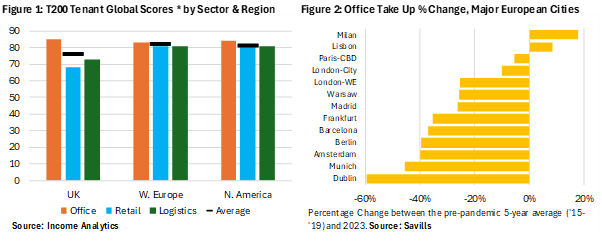

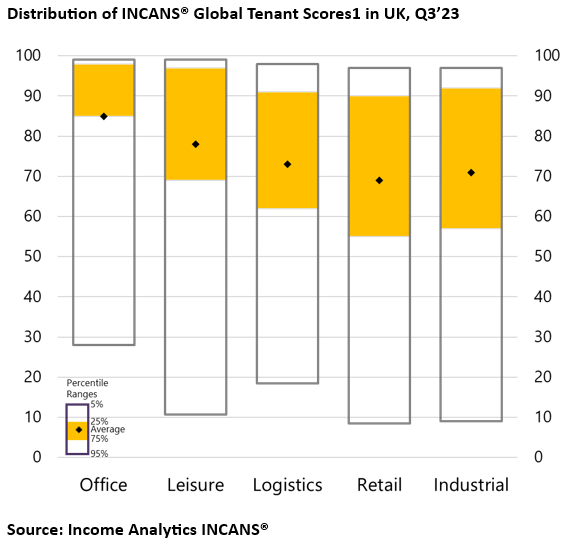

Income Analytics’ give all companies an INCANS® Tenant Global Score from 1 to 100. These relate to a probability of default and predict the likelihood that a company will seek credit relief or fail, 1 being the worst. The unweighted aggregate score of the top 20 retail park occupiers is 74/100. To give this context, the UK retail average is 68 so the top 20 average is better than the wider market. It is bolstered slight by the presence of grocers who are typically stronger than general retailers, but DIY specialists also out-perform UK retail.

We also calculate the probability of default across this retail group, and we can compare it to corporate bonds to calculate an equivalent bond default risk. Unweighted, this group of 20 would have a default risk equivalent to BB+ i.e. borderline investment grade corporate bonds.

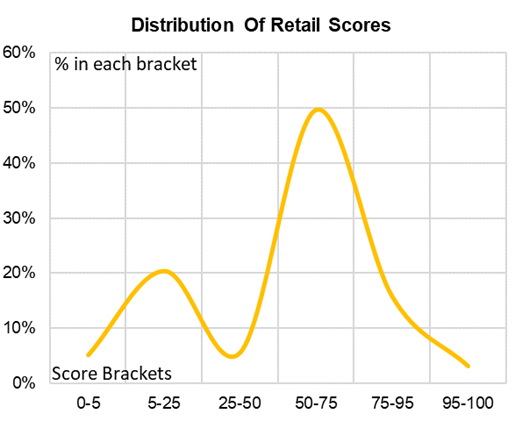

However, this is where it becomes important to look at the mix of risks across the top 20. It may surprise you. The left-hand chart shows the distribution of the risks across this group, with some occupiers facing a much greater probability of default than others. The right-hand chart shows the equivalent bond default risk across the same group. Just 1 of the top 20 fall into the Low Risk category, though good news for investors in this sector, 12 are Medium-Low Risk. That means 65% of the top 20 occupiers would be considered at little risk of defaulting on their leases. Landlords just need to worry about the remaining 35% who find themselves at more risk of struggling to meet their lease obligations in the future.

Landlords will want to ensure that are either managing their leasing to ensure they have the right tenants in place to minimise their income risk, have guarantees in place, or look to right-size the rent to get as close to risk-neutral as they can.