The webinar, hosted by Matthew Richardson, was the third in a series, this time exploring the European office market. It featured three expert speakers: Andrew Angeli (Zurich Insurance), Cecile Babcock (Edge Technologies), and Mike Barnes (Savills).

Market Outlook – Andrew Angeli (Zurich Insurance)

Andrew Angeli presented a cautiously optimistic view of the European office sector. Despite recent underperformance and negative sentiment, he argued that offices remain a strategic asset class, especially for institutional investors like Zurich Insurance.

-

Offices still accounted for 21% of European investment activity in 2024.

-

Investor surveys may overstate the decline in office appeal.

-

Zurich’s portfolio remains heavily weighted toward offices, particularly in Switzerland, Germany, Iberia, and France.

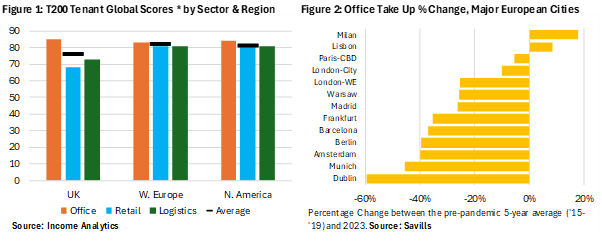

Angeli emphasized that asset-level selection is now more critical than sector-level allocation. He noted that while the U.S. office market suffers from high vacancy and oversupply, Europe’s Grade A space remains in demand. Asia-Pacific markets like Tokyo and Singapore are also performing well.

He also highlighted that:

-

Remote work is stabilizing, with more companies mandating office attendance.

-

Supply pipelines have largely shut down, limiting new development.

-

This supply-demand dynamic could lead to rental growth and improved performance.

Developer Perspective – Cecile Babcock (Edge Technologies)

Cecile Babcock echoed Angeli’s optimism but focused on the development and sustainability angle. Edge Technologies, a sustainable real estate developer, is shifting from ground-up projects to retrofits and refurbishments, driven by both carbon concerns and market timing.

-

Demand is rising for Grade A+ office space in prime locations.

-

Institutional capital is returning as risk perception declines.

-

Sustainability is no longer a premium—it’s a prerequisite for tenants and lenders.

She noted that private equity and family offices have been the most active investors recently, but institutional players are re-entering the market. Cecile emphasized that brown-to-green strategies require deep technical expertise to be financially effective.

Return expectations:

-

Core-plus risk for value-add/opportunistic strategies in line with INREV’s definitions.

-

The current opportunity window may close within 12–18 months.

Research & Leasing Trends – Mike Barnes (Savills)

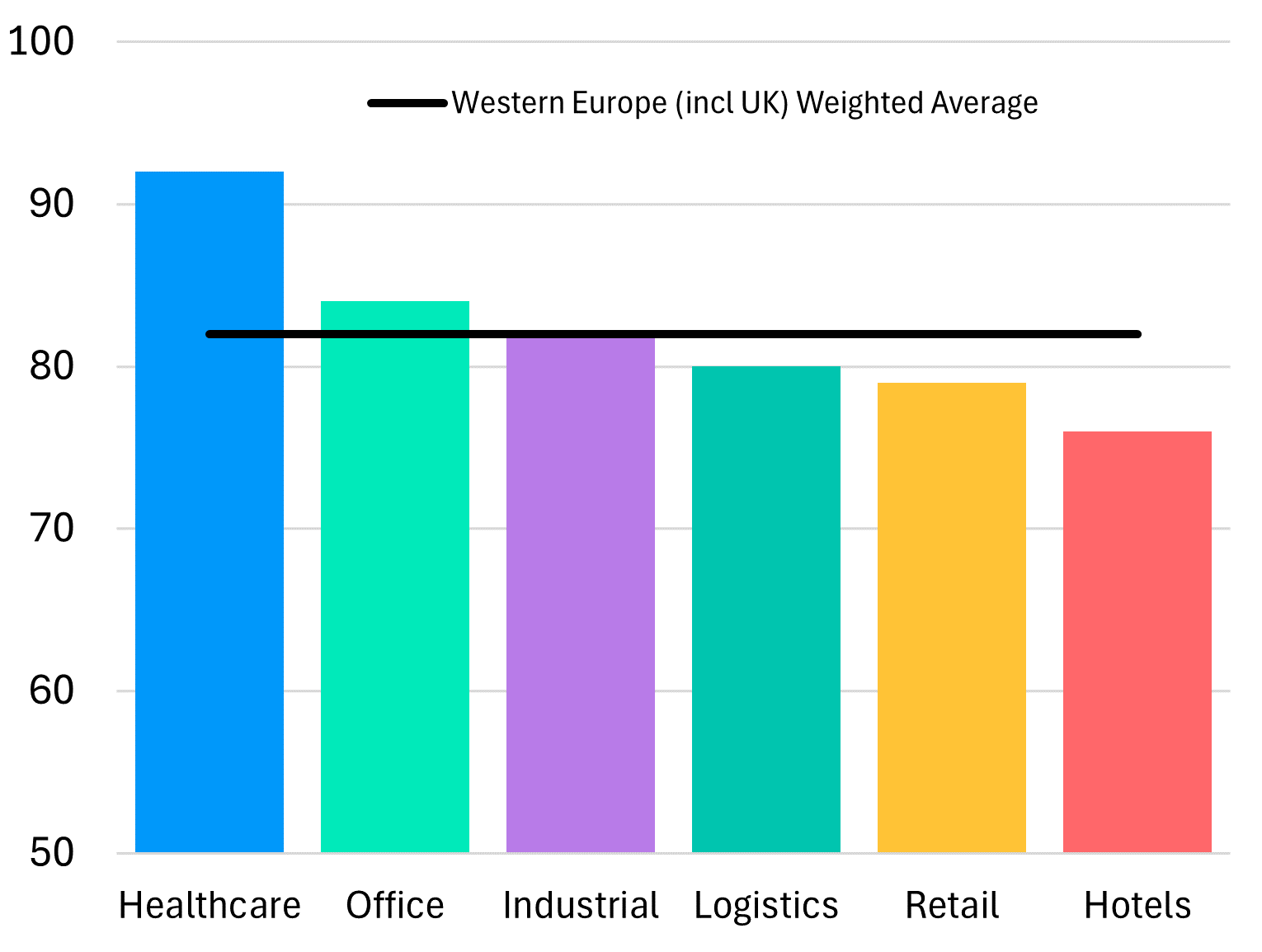

Mike Barnes provided a data-driven view of the leasing and investment landscape. He confirmed that leasing activity is recovering, with a 3–5% year-on-year increase in 2025. Demand is strongest in CBDs, especially in cities like London, Milan, and major German hubs.

-

Rental growth over the past 5 years: ~19% in CBDs vs. ~8–9% in non-CBDs.

-

Grade A vacancy in prime cities is low (~2–4%), supporting further rental growth.

-

Flex space and plug-and-play offices are gaining popularity.

Barnes also addressed the impact of AI, suggesting it will have a modest net positive effect on office-based employment. He noted that lease terms are evolving, with more landlords offering flexible, ready-to-occupy spaces.

Q&A Highlights

-

Zurich is not increasing its office exposure but is rebalancing toward logistics and residential.

-

Debt markets are active for green, prime assets; private credit is growing as banks retreat.

-

Demographic shifts (e.g., aging populations) may lead to more repurposing of older stock.

-

The end of upward-only leases in the UK is not expected to impact prime assets significantly.

-

Swiss office markets remain attractive due to favourable yield spreads over low bond rates.