We are pleased to announce the publication of our ELAM technical paper in collaboration with Andrew Baum, Emeritus Professor at the Saïd Business School, University of Oxford.

This paper was prepared in response to the Pereira Gray report for the RICS published in December 2021 which recommended that “the valuation profession should incorporate the use of discounted cash flow as the principal model applied in preparing property investment valuations”. Other recommendations related to (i) greater use of sophisticated modelling and analytics, and (ii) a standardised approach to risk pricing.

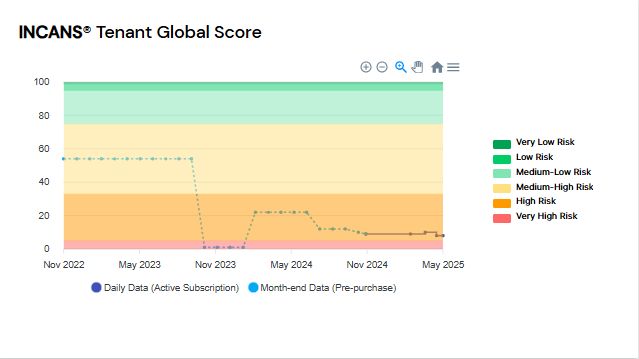

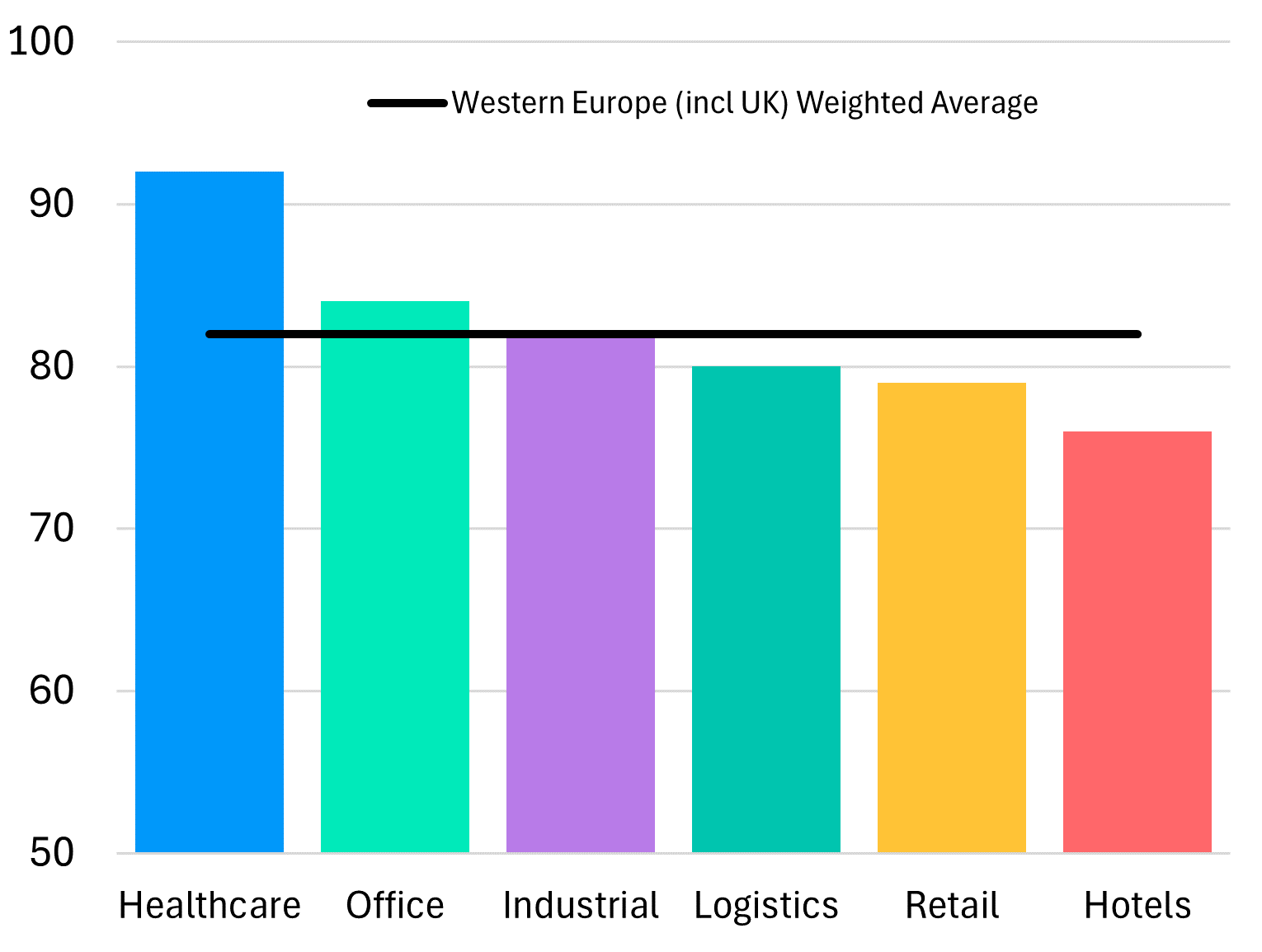

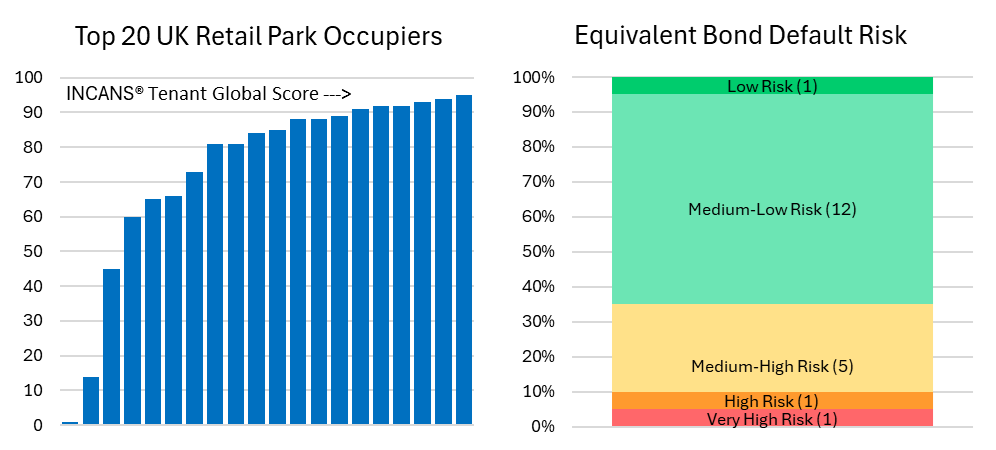

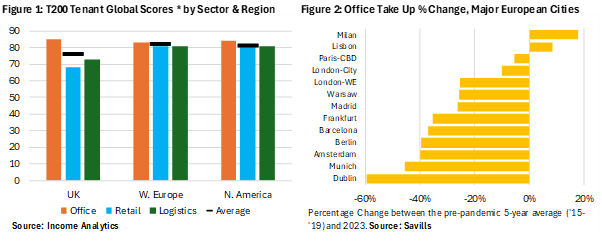

At Income Analytics we have developed INCANS® Scores that provide users with a long-term projection of % probability of tenant failure/default that can be matched to the lease length. In this paper we explain how these probabilities of default or “PD rates” can be used in valuation DCF models so that valuers can finally isolate and quantify the “quality” of one tenant vs another in their modelling work.

We hope you find this report a useful step forward in helping valuation professionals in their transition to DCF modelling and helps them meet the reports’ recommendations relating to (i) greater use of sophisticated modelling and analytics and (ii) a standardised approach to risk pricing.

Looking a little further ahead, we are pleased to announce that we will be releasing this work as a new analytical service on the INCANS platform in Q1 2024. Called the Expected Loss Adjustment Model or “ELAM”, this new tool will provide Valuers with the ability to combine the INCANS® Tenant Scores (and their associated PD rates), with lease/unit/market-specific reletting assumptions (such as expected void length, vacant and reletting costs, under/overrenting, etc), to calculate an Expected Loss of discounted cashflow for this lease given the tenant quality. This expectation can then be used to calculate the corresponding additional risk premium in isolation to directly adjust their valuation cap rate.

More recent comments from RICS have suggested that they want clients to be able to understand the journey the Valuer has taken to come to their conclusions – with the Valuer able to show transparency and objectivity, and the ability to document and articulate all assumptions made.

To download the Technical Paper please click here