Income Analytics today announces the launch of its tenant income risk indices and benchmarks – a new and unique set of indicators for quantifying tenant income risk using data on over 355 million global companies from leading global provider of business decisioning data and analytics, Dun & Bradstreet.

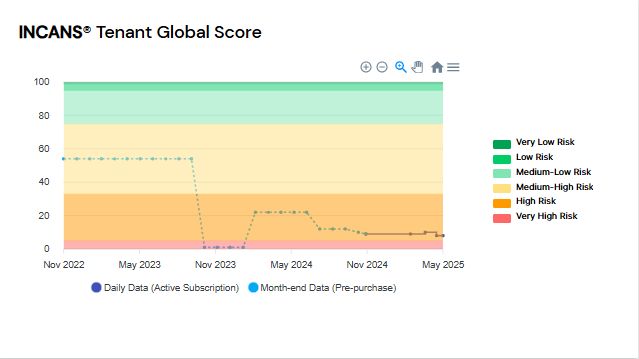

Income Analytics redefines how the global real estate industry can access, analyse and deploy company credit data on tenants, real estate assets and investment portfolios, enable real estate professionals, investors and lenders to receive ‘real time’ analysis of underlying tenants creditworthiness and, with confidence, appraise anticipated future performance and ultimately likelihood of default.

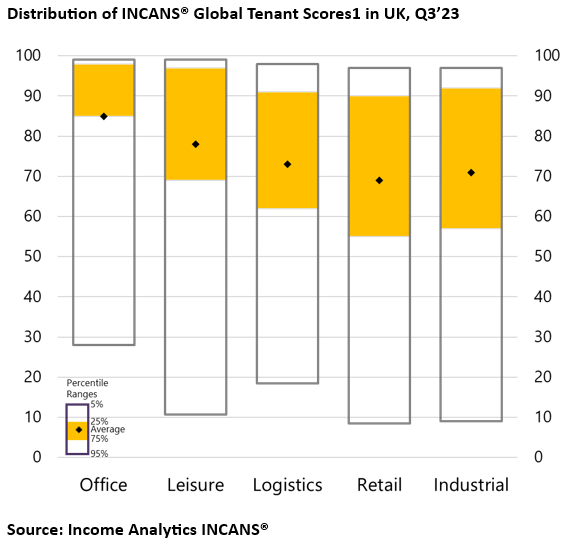

Income Analytics reports and dashboards incorporate new proprietary analytical tools and scoring (INCAN scores) alongside the existing credit report data including:

- 10-year tenant income risk forecast

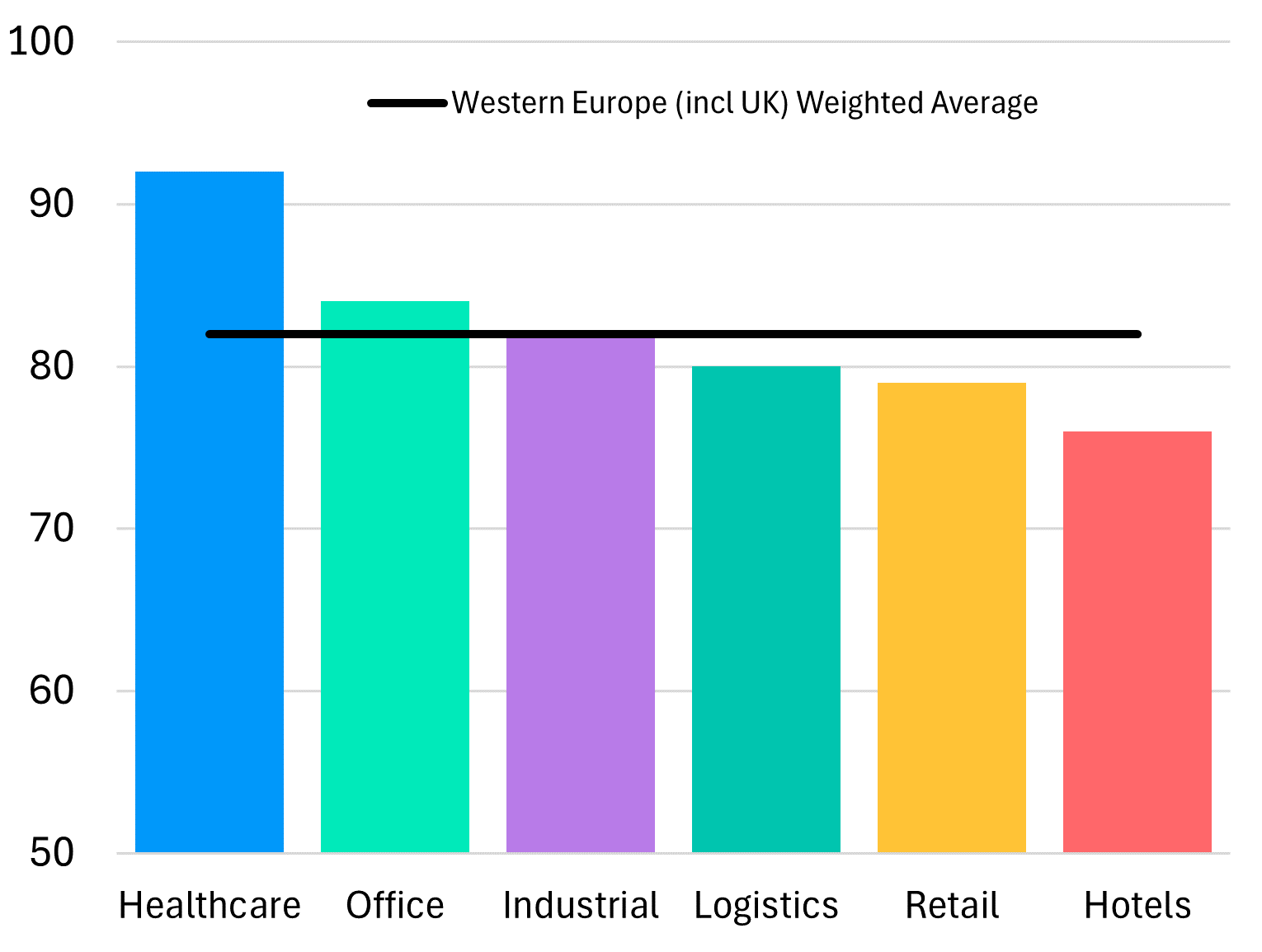

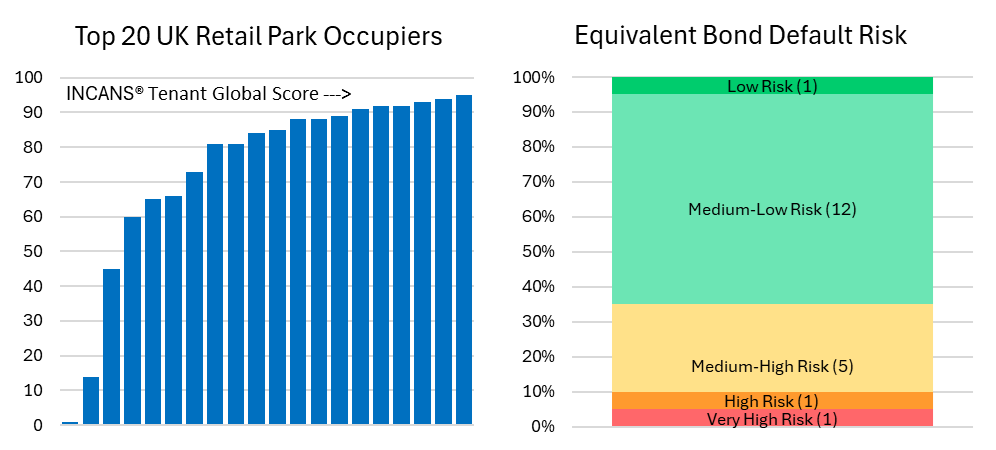

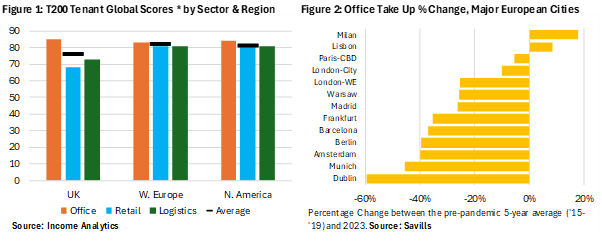

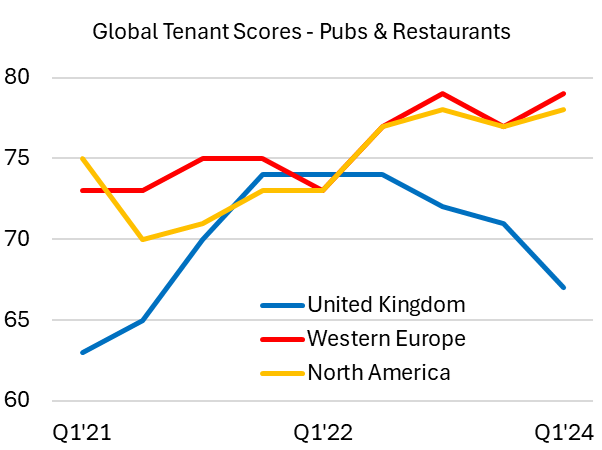

- Global tenant scores

- Bond equivalent ratings

- Global corporate family tree

As a global institutional asset class (US$30.2trn1), real estate requires the same analytical analysis as equities and bonds. As stated by Andrew Baum, Professor of Practice, Said Business School, University of Oxford: “The value of real estate investment is ultimately determined by the level, duration and quality of the rental income paid by your tenants.”

Income Analytics provides a range of tools comprising:

- Tenant credit reports – Identification checks, quality of covenant and probability of default along with the usual company financials;

- Asset level credit reports – Aggregated income stream analysis and assessment of probability of loss; and

- Portfolio Income Manager – A platform to view and monitor the financial health of existing tenant and portfolio income quality 24/7.

Matthew Richardson, Co-founder and Chief Executive Officer of Income Analytics commented: “At Income Analytics, we have created a truly unique and much needed set of tools and analytics for the global commercial real estate industry. No industry specific product for investors and lenders to assess and monitor the changing quality of their tenant income over time currently exists. More worrying is that very little has changed since the sub-prime crisis of 2008 and the recent global crisis caused by Coronavirus makes the need to access accurate and current income data more important than ever before. Our aim is to provide the real estate industry with a critical tool in which to assist investment decisions and investor reporting.”

Maxwell James, Chairman of Income Analytics stated: “Income Analytics has created a new and world class set of indices and benchmarks for the commercial real estate market. The insight that these measures bring is already resulting in better informed investment decisions by our existing clients. The application of these analytical methods offers the potential for investors and lenders to greatly enhance transparency and risk appraisal of portfolios or loan books at this critical time.”

Edgar Randall, Commercial Director UK & Ireland, Dun & Bradstreet commented: “Dun and Bradstreet is delighted to be partnering with Income Analytics to provide commercial data and analytics that support innovation and digital transformation across the real estate industry. Our aim is to provide a comprehensive risk solution for commercial real estate teams by combining our data with Income Analytics’ expertise and new platform to deliver actionable insights to drive business performance.”

Income Analytics was founded by and is led by an award-winning management team with unique experience and a strong track record in data monetisation and analytics in the commercial real estate sector.

In light of the current COVID-19 situation the formal launch event has had to be postponed but details will follow in due course.

Read the full article HERE.