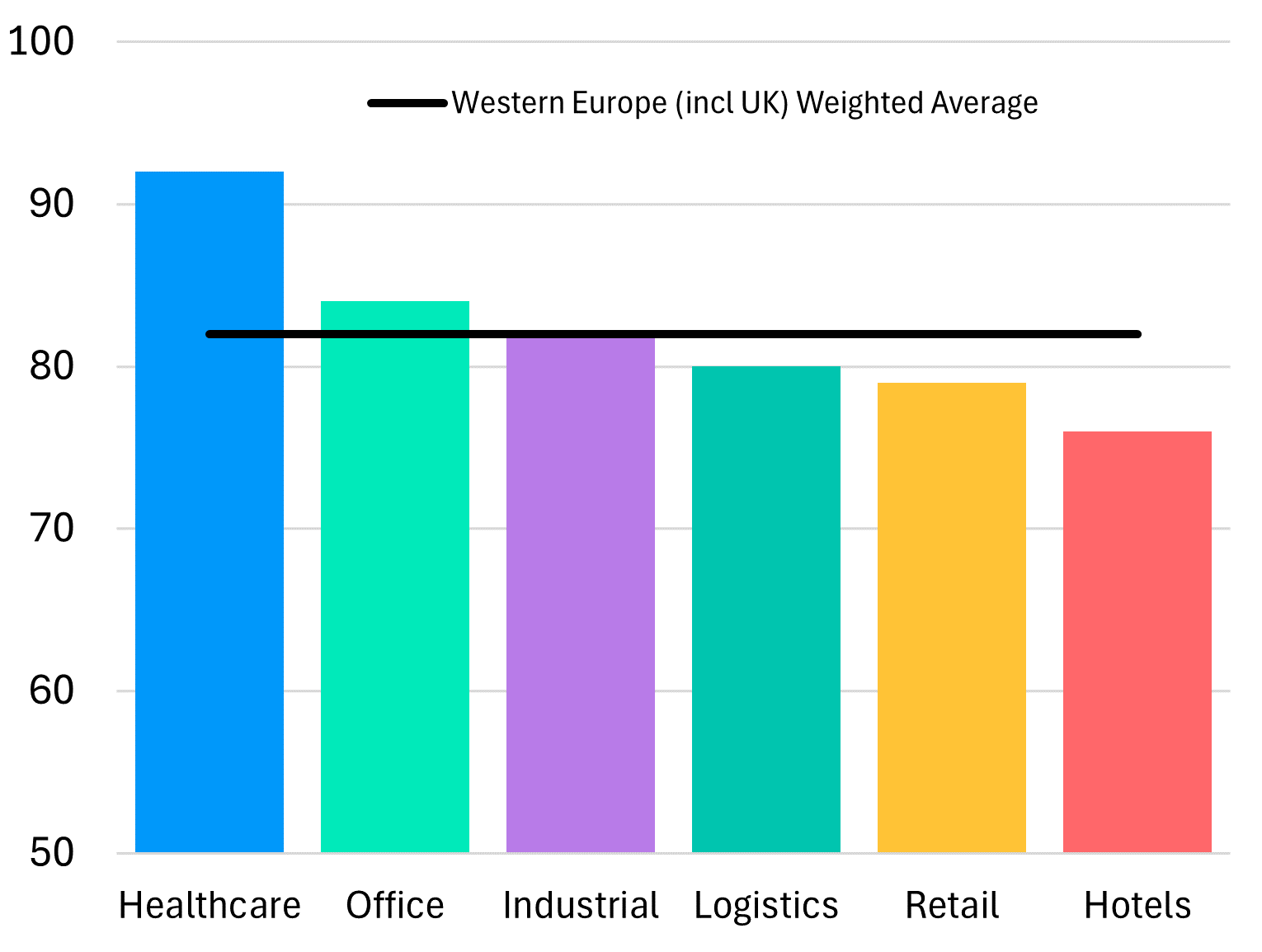

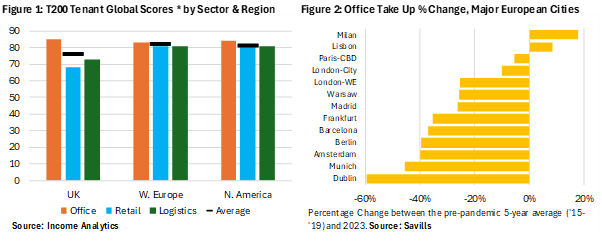

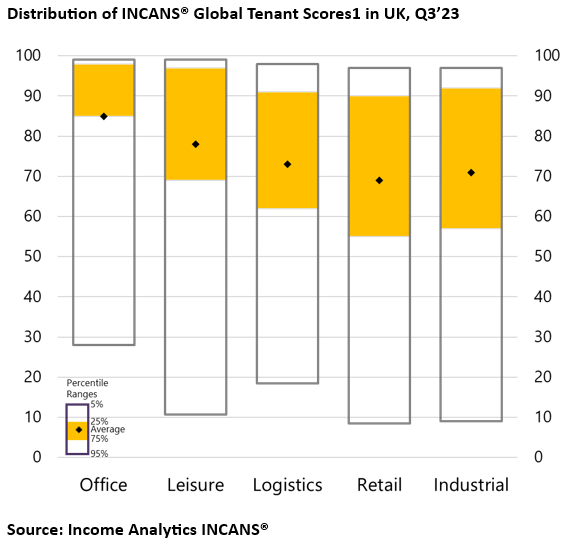

Businesses in the Logistics Sector are the Highest Risk Tenants, while those in Healthcare and Education present the lowest risk. These are the findings of the INCANS Top 200 Averages for Q2 2022.

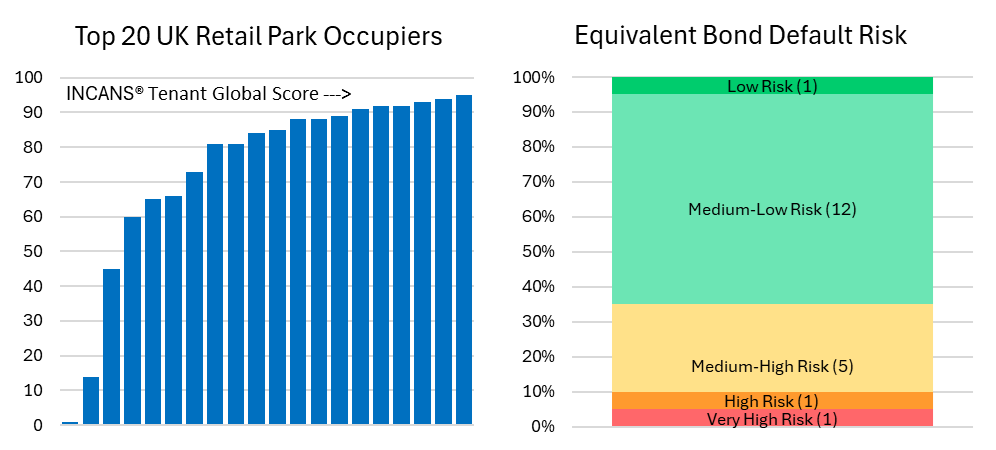

The ratings, created by Income Analytics, give Real Estate Professionals a likelihood of Tenant Failure by using Advanced Statistical Modelling. The lower the score, the higher the risk of default.

The following are most challenged sectors using data to the end of Q2 2022:

• Logistics: The surprisingly high tenant default risk can in part be explained by the operational nature of small logistics businesses’ leases; leases end when contracts end. However, it signals a trend of logistics businesses succumbing to the pressure of the Retail Landscape and Supply Chain crisis.

• Leisure: The Leisure Sector continues to reel from the impact of the pandemic, as well as the cost-of-living crisis. While many have gone bust, others continue to struggle.

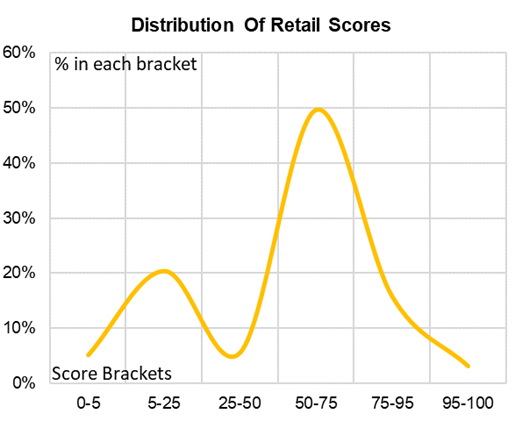

• Retail: The Retail Sector’s struggle is to be expected due to the structural shift away from bricks-and-mortar sales to online retail, a challenge exacerbated by the pandemic.

When Sectors are broken down further, three subsectors stand out:

• Motor Dealerships: A perfect storm is hitting the sector, combining the move to electric vehicles with supply chain challenges and a shift to online sales.

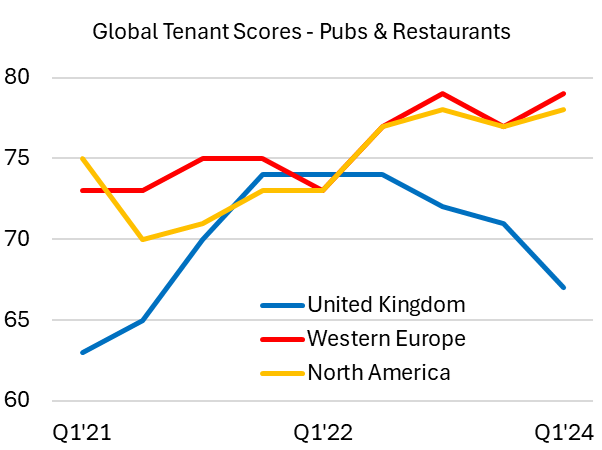

• Pubs, Restaurants and Hotels: The impact of the pandemic is making way for the impact of the cost-of-living crisis as spending falls.

• Department Stores: The score is high but reflects the low number of department stores left as many close their doors or move to online.

INCANS Top 200 Averages Methodology

The INCANS® Top 200 Averages have been developed by Income Analytics using company level data provided by Dun & Bradstreet. The figures are calculated at the end of each quarter generating an average % probability of failure for the top 200 companies in each of the 83 x SIC 2 industry code type across a particular country or geographic region.

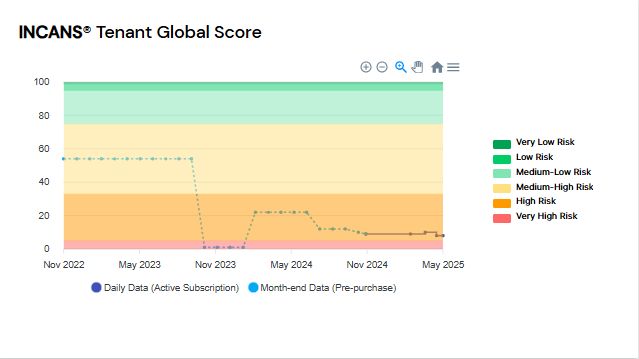

What is the INCANS® Tenant Global Score?

The INCANS® Tenant Global Score is a normalised international cross border score that predicts the likelihood that a company will seek credit relief or, worse, go out of business within the next 12 months. The scale is based on the historical default data from every company over recent history. A higher score indicates a lower probability of failure or default.

It can be interpreted as the rough percentile the company sits in against all global companies in terms of their failure risk over all modern history. For example, 100/100 means that the company is broadly in the top 1% of all global companies that have existed over modern history – it is least likely to fail. A score today in any country is comparable in risk level with the same score at any point in time in any other country.

Please find attached link to view full T200 Report