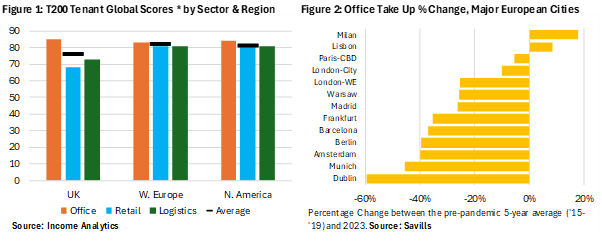

How often have you described an asset as “prime” because it sits in London’s West End? Or “opportunistic” because of an emerging asset class? Such labels are a form of “information framing” and it is natural human behaviour. The way choices are presented can influence our thought processes and ultimately our decisions. This can play out badly in many situations. In commercial real estate, there is plenty of evidence that shows how often investment decision-making processes are fundamentally flawed because of how we label and use much of the information and data available to us.

Today, a real estate fund manager can walk through the door and describe the perceived risk profile of an asset or fund with one word: “prime”, or “core”. In contrast the risk profile of a bond fund would be determined by risk & return metrics not simply the opinion of the fund manager. What is needed in real estate investment markets is a structural rethink of how investors can assess an opportunity, using quantitative data rather than subjective labels based on postcode or use class, created by the long line of investors and agents who came before. With the tools available today, this is certainly possible.

Read the full article HERE.