It is the question on every property owner’s mind right now: Are my tenants able to keep paying the rent?

Tenant risk is the single most important factor in real estate, which the coronavirus crisis has bought into sharp focus by forcing tenants in multiple sectors to close virtually overnight.

For many years, real estate has been ignoring the importance of tenant risk, or has been measuring it the wrong way, according to some in the industry. And in the midst of the crisis, proptech firms are trying to change the way owners look at risk.

“The basic fact is that in commercial real estate investment, over the long term most of your total return comes out of rental income rather than capital growth,” Income Analytics Chief Operating Officer and co-founder Matthew Richardson said.

“People are making the assumption that this will be the same kind of crisis as 2008, but that was a credit crunch, and today there is plenty of equity in the market. This is a crisis of servicability; can tenants keep paying their rent so borrowers can keep paying their interest?”

Richardson, a former Fidelity head of EMEA real estate research, has teamed up with real estate data veteran Matthew Hopkinson to last week launch Income Analytics, which is looking to essentially become a credit rating agency specifically for commercial real estate.

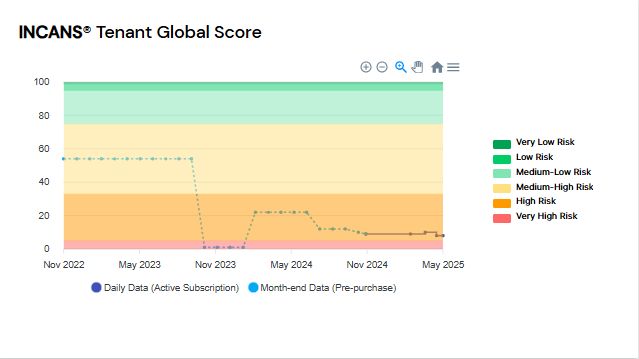

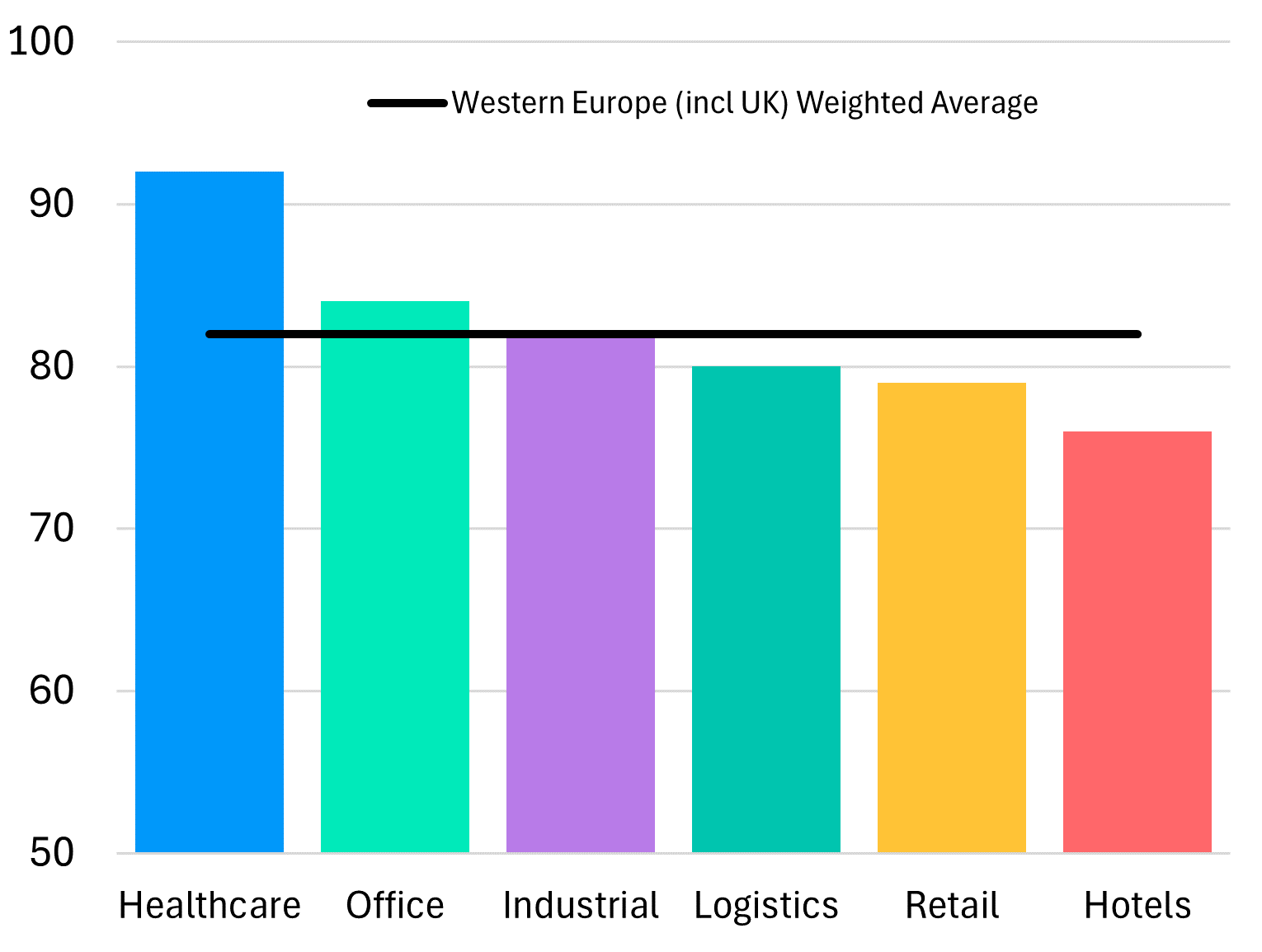

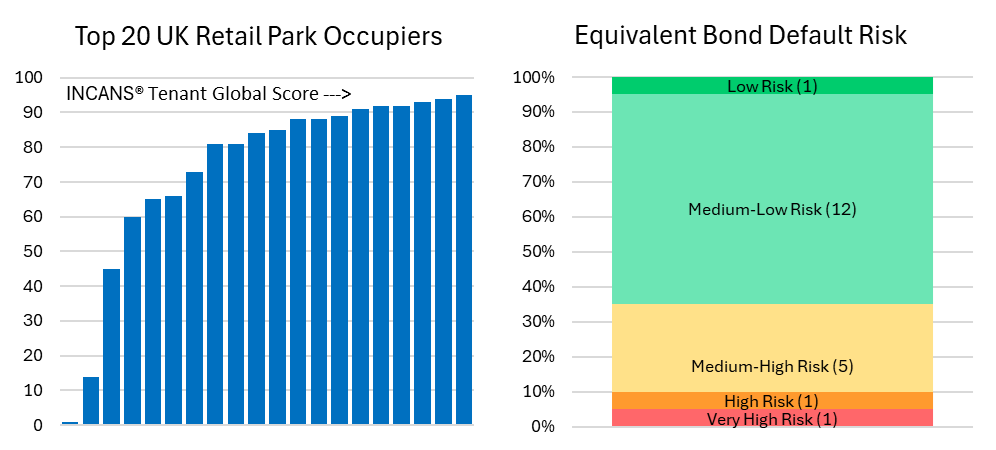

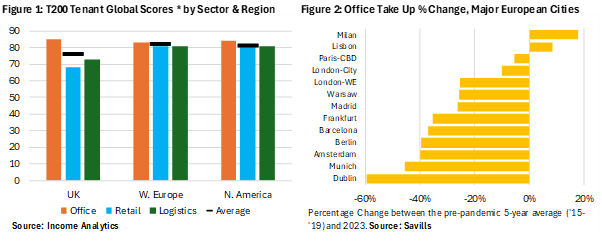

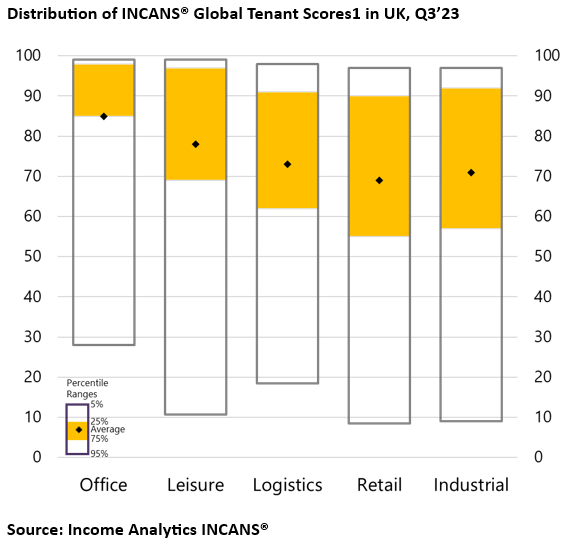

In partnership with credit rating agency Dun & Bradstreet, it takes the typical credit rating of a tenant and uses its platform to turn that into data about how likely a tenant is to go bust or stop paying its rent over the next one to 10 years. It can analyse the risk attached to single buildings or wider portfolios.

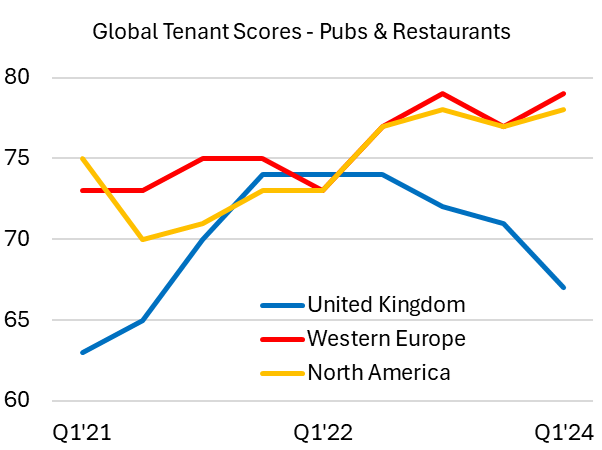

It also provides scores for tenants across the globe, and provides information about the corporate “family tree” of a tenant, to analyse if there is any hidden risk in an occupier’s overall corporate structure.

Richardson said a key metric the platform will utilise in the coming weeks and months is whether companies are taking longer to pay suppliers. For smaller companies in particular this is a signal of growing distress.

Hopkinson and Richardson were working on the project before the coronavirus crisis struck, partly in response to the number of bond investors who invested in real estate for the first time in recent years: The company can provide information that essentially says if this property was a bond, it would have this credit rating, based on the quality of the tenants.

But as a result of the pandemic, there has been a sudden clamour from the market to measure the tenant risk of portfolios more accurately.

“People want to understand what they are exposed to,” Richardson said. “Rather than saying, I think this is a good company, they want factual evidence. Or they might be lent on by their creditors, who want to know the state of their cash flows.”

He said some of the investors using the platform are even using the fact they have a sophisticated risk management system as a marketing tool.

Richardson’s comments on the desire for insight during the crisis are mirrored elsewhere in the proptech world.

“It’s all about risk calculations today,” commercial real estate investment platform Coyote Software Chief Executive Oli Farago said. “How can I analyse how exposed I am to a particular sector? Asset managers are being bombarded with requests not to pay rent, and their investors want to know what percentage of their tenants are not paying.”

He added that these calculations on tenant risk will be much closer to the forefront when future deals are underwritten, especially on portfolios that are being sold in distressed situations over the coming months and years.

“There is going to be a lot of competition for these deals, and investors are going to have to act fast. If you’ve got the best information about what deals are being done and what is happening with tenants, then you can get out of the blocks quickly.”

Income Analytics co-founder Hopkinson said this crisis amplified the need in the struggling retail sector for landlords and retailers to work in partnership to make the market more resilient.

“It has been an adversarial situation, and perhaps COVID-19 will make people realise the link between income and the rent that tenants can afford to pay,” he said. “I think you are likely to see shorter leases and more flexibility in future.”

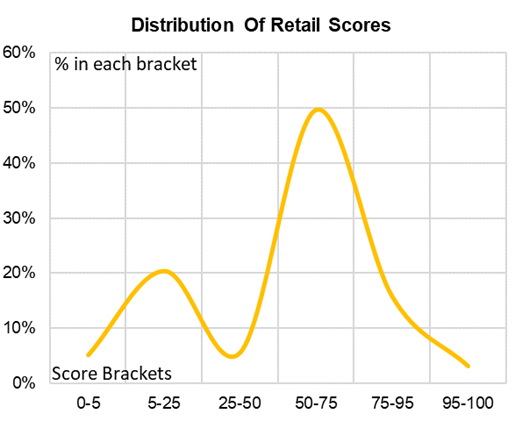

Richardson pointed out that retail had hit the skids during a time of economic growth and low interest rates, and said if it couldn’t thrive in that environment, much of it is already doomed. For landlords right now, it is about picking which tenants are going to make it through the crisis and the period that comes afterward.

“Whether it is retailers or serviced office operators, those that can make it through into the sunlight on the other side can rule the world, as competitors fall by the wayside,” Richardson said.

For landlords, how you work out who that is has never been more important.

To read the full article click HERE