Back in my day all this was fields….

Over the last 30 years institutional investors have come to dominate the real estate investment markets in North America, Europe, Australasia and much of China and SE Asia. But this was not always the case. Prior to the mid-1980s, most real estate investment liquidity was generated domestically from local investors — usually through syndication networks and major real estate families. Insurance companies and side-arms of local banks also invested but almost always directly into specific properties.

From the early 1990s things changed as the financial industry created and popularized an array of new products designed to increase diversification, specialization, and financial engineering. Products such as publicly-traded real estate investment trusts (REITs), private equity, open-ended investment funds, and various asset-backed securities distanced real estate investors from direct ownership.

The real catalyst for the financialisation of real estate as an institutional asset class can probably be traced back to the US Savings & Loans Crisis of the late 1980’s and early 1990’s. when 1,043 out of the 3,234 savings and loans associations in the US failed.

Unlike the more recent 2008 financial crisis, in the S&L Crisis the federal government took over 747 of these failed banks and ended up with thousands of loans and properties under their control. The solution at the time was to create a government-run entity known as the Resolution Trust Corporation (RTC) to asset manage and eventually sell off all the loans and properties back to the private sector.

Over time the RTC accumulated thousands of real estate assets on its balance sheet. The challenge then became how to unload such an enormous number of buildings. The government could not simply sell each property or loan one at a time. Instead, they had to start selling them en masse by grouping assets into pools.

Property Pools

Because these pools held so many properties, usually spread over a wide geographic area and including all types of buildings (retail, office, industrial, etc.), the sheer scale of the offer meant that anyone wishing to purchase these portfolios from the government would need to raise large-scale investment funds. So, while the logical buyer of a single property would be real estate professional, the natural purchaser of a pool was a financial company. One single building is a place. One hundred buildings pooled together is a financial asset.

In effect, the RTC created by the federal government helped spawn the new industry of asset pooling, in particular "blind pools" of real estate private equity. Not only were private equity funds best suited to purchase these pools of government assets, but they ended up making enormous profits. In retrospect, it turned out the government was selling off these real estate assets at fire sale prices. Often there would be only a few buyers for assets that were returning un-geared yields over 15% on heavily depressed income streams.

After they had exhausted the US market, they turned their focus to international real estate and a new global investment asset class was born.

Financialisation of Real Estate

Once the early private equity funds had successfully proven the model, the trickle of capital turned into a flood. Real estate private equity grew from a few billion dollars in the early 1990s to more than $900bn under management today (Prequin 2019).

In a separate but related consequence of the real estate recession of the late 80s, most major real estate companies took their assets public on the New York Stock Exchange as Real Estate Investment Trusts (REITs). Other countries soon followed and REIT markets grew from a few billion dollars in 1990 to a global industry worth more than US$2.3trn by December 2020 (EPRA Total Markets Table Q4 2020).

The enormous value of property assets controlled by private equity and REITs does not even include Commercial Mortgage Backed Securities (CMBSs) and other asset backed securities pools (e.g., CDOs) that also total in the hundreds of billions.

Today the modern real estate investment industry stands transformed. For the first time it can be genuinely described as a global institutional asset class and in this brave new world it is the financial professional who has become the primary manager and driver of real estate decision-making.

New Challenges for Real Estate Investment Markets

While the market participants and scale of investment has changed global real estate investment markets remain anchored in the past in several key regards. Legal and tax issues have prevented seamless movement of capital and continue to create local market distortions but perhaps the biggest single challenge facing the sector from a professional investors perspective remains the lack of transparency, non-standard reporting and poor data quality.

As regulated asset classes, investors in equity and debt markets benefit from access to a wide range of data services and analytical tools to help them identify opportunities and price risk. Disclosure and reporting is regulated so investors can easily analyse investment performance. In contrast, commercial real estate investors often suffer an “information deficit” and have limited access to the underlying facts and figures when considering a deal.

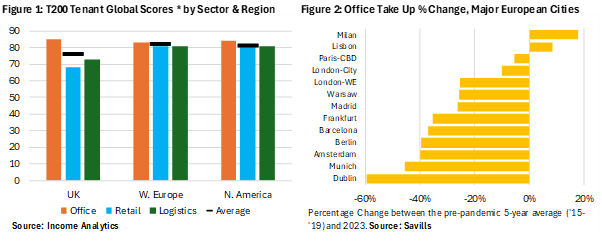

This is nowhere more apparent than in the analysis of tenant income risk. Despite ample evidence that income return is the primary driver of long term investment performance across most major real estate investment markets (MSCI Indices) very little time and effort is spent on quantifying the probability of rental loss and or tenant failure.